Grow your business + keep your equity

Invoice factoring provides the working capital your business needs.

At Catalyst, we specialize in invoice factoring, also known as accounts receivable financing which helps businesses that don't meet the requirements for a traditional line of credit. We can help you significantly improve cash flow at reasonable, competitive rates.

Our team provides a level of service and personalized attention uncommon in our industry. You'll have a direct contact who manages your account and provides assistance with credit decisions.

In addition, with Catalyst, you'll experience:

- No maintenance fees

- Online reporting

- Rebates paid weekly

- Advance rates up to 90%

- Daily reporting of receipts

- No long-term contracts

- Recourse and non-recourse programs

Typical company profiles include:

- Young businesses that haven't been in business long enough for traditional LOC

- Companies growing at rates that exceed bank risk portfolios

- Companies with high concentration of one or two clients

- Companies that used to qualify for bank financing, but are now going through a business challenge

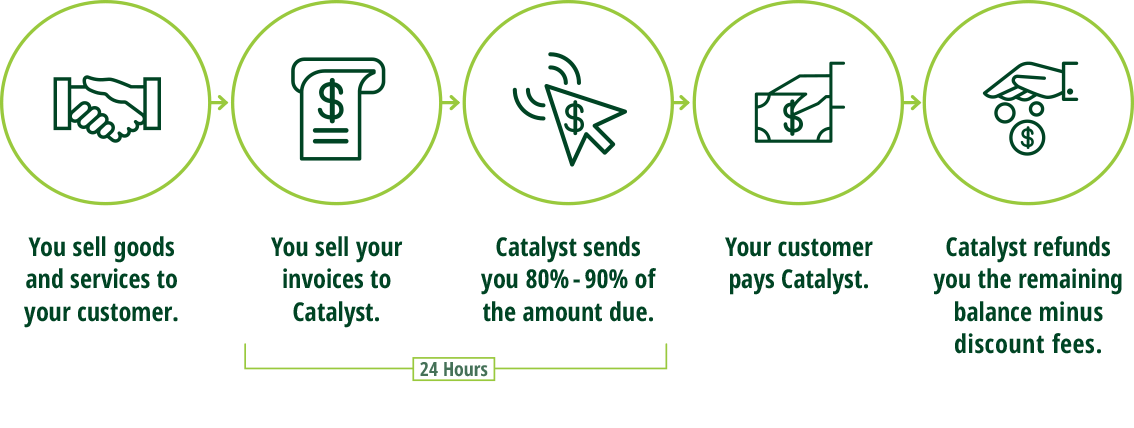

HOW INVOICE FACTORING WORKS

Common questions about factoring with Catalyst

Many of our customers have never financed using accounts receivables financing. We're here to help you understand the process and make it work seamlessly for your business.

Have more questions? Get in touch with our team.