Distribution Factoring

Invoice factoring gets distribution companies cash faster.

For more than 30 years, Catalyst has provided distribution factoring and other financing options to businesses in the distribution industry. We have worked with many entrepreneurs to launch or grow their business in the distribution industry and understand the unique challenges that businesses in this industry face: seasonal purchasing cycles, customers that pay on 30, 60, or 90+ day terms, slow-paying customers, and more.

These challenges lead to extreme fluctuations in cash flow that prevent you from making monthly payments, offering more generous payment terms, taking on new product lines, or benefiting from early pay discounts offered by suppliers.

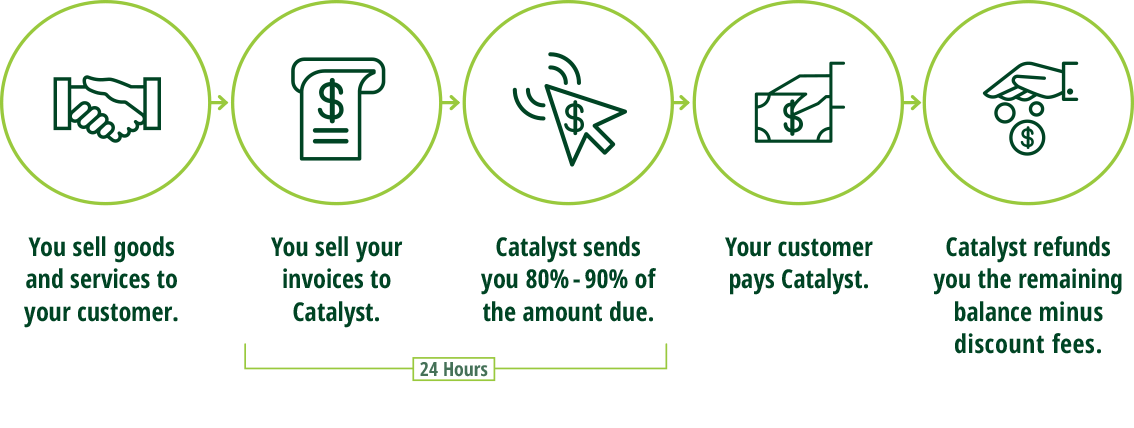

Factoring with Catalyst can help you get cash as soon as your invoice is generated.

This type of financing, known as distribution factoring, invoice purchasing, factoring, or accounts receivable financing is what we have specialized in at Catalyst. We can help you significantly improve cash flow at reasonable, competitive rates.

Why factor with Catalyst:

Our team provides a level of service and personalized attention uncommon in our industry. You'll have a direct contact who manages your account and provides assistance with credit decisions.

- Highly competitive rates

- No long-term contracts

- No maintenance fees

- Online reporting

- Rebates paid weekly

- Advance rates up to 90%

- Daily reporting of receipts

- Recourse and non-recourse programs

- No exit fees

- Equipment financing available

Request Invoice Factoring Now

Complete as much of this quick form as you can and we will get your approval started!