Staffing Factoring

Payroll factoring gets staffing agencies cash faster.

For more than 30 years, Catalyst has provided financing options to staffing agencies.

We understand that in the staffing industry, having a consistent cash flow is extremely important in order to meet weekly payroll. Long payment times and slow-paying customers can leave you without enough cash in hand to make these payments.

Catalyst Financial can help you get cash as soon as your invoice is generated.

We specialize in staffing factoring and payroll factoring at Catalyst. Our staffing factoring solutions can help you significantly improve cash flow at reasonable and competitive rates.

We have helped countless staffing agencies manage their cash flow in order to hire more employees and help fund payroll. In most cases, staffing compa30nies are prequalified to factor with us because of the transactional nature of the business; invoices are provided for each employee and show proof of payment.

Why factor with Catalyst:

Our team provides a level of service and personalized attention uncommon in our industry. You'll have a direct contact who manages your account and provides assistance with credit decisions.

- Highly competitive rates

- No long-term contracts

- No maintenance fees

- Online reporting

- Rebates paid weekly

- Advance rates up to 90%

- Daily reporting of receipts

- Recourse and non-recourse programs

- No exit fees

- Equipment financing available

Request Staffing Factoring Now

Complete as much of this quick form as you can and we will get your approval started!

You can also call us at 281-870-9182 to start the approval process right now!

Staffing Factoring Case Studies

Is Invoice Factoring Right for Your Staffing Company?

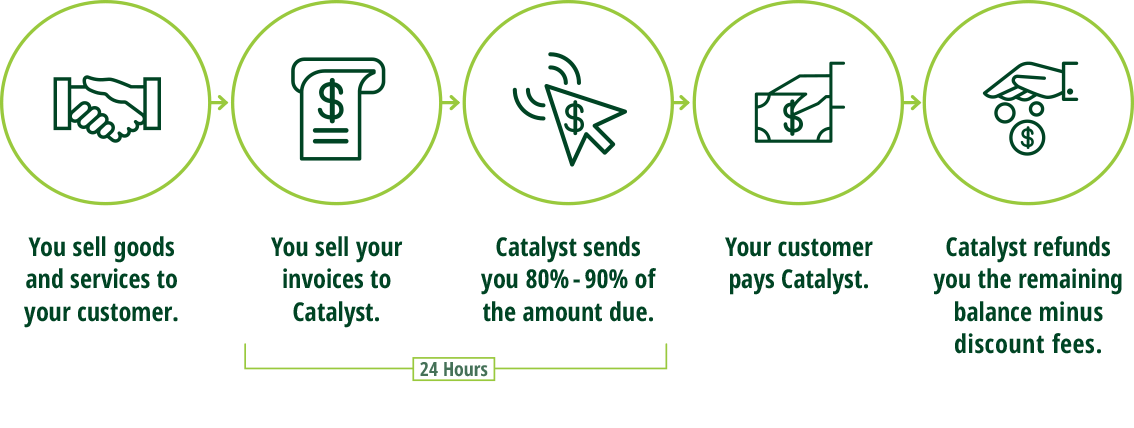

Staff factoring is a sale of outstanding payroll invoices to a third-party factoring company. It is a type of business financing to maximize cash flow and effectively fund daily operations. Staffing factoring allows staffing businesses to access the capital needed to recruit, hire, onboard, and run payroll.

Your financial interests are our top priority.

No long term contracts means that as soon as your business is ready, we help you transition to a traditional bank line of credit. Many of our customers actually come to Catalyst because their banker refers them and trusts us to provide the best service. Our average customer works with us for 18-24 months before qualifying for a line of credit.