Texas Factoring

Grow your business + keep your equity

Invoice factoring provides the working capital your business needs.

At Catalyst, we specialize in invoice factoring, also known as accounts receivable financing which helps businesses that don't meet the requirements for a traditional line of credit. We can help you significantly improve cash flow at reasonable, competitive rates.

Our team provides a level of service and personalized attention uncommon in our industry. You'll have a direct contact who manages your account and provides assistance with credit decisions.

In addition, with Catalyst, you'll experience:

- No maintenance fees

- Online reporting

- Rebates paid weekly

- Advance rates up to 90%

- Daily reporting of receipts

- No long-term contracts

- Recourse and non-recourse programs

Typical company profiles include:

- Young businesses that haven't been in business long enough for traditional LOC

- Companies growing at rates that exceed bank risk portfolios

- Companies with high concentration of one or two clients

- Companies that used to qualify for bank financing, but are now going through a business challenge

$0B

Funded0+

Companies Funded0

Account DebtorsGetting Started

To get started, fill out the form below and we will get back to you within 24 hours.

Our team is also available by phone at 281-870-9182 or email at [email protected].

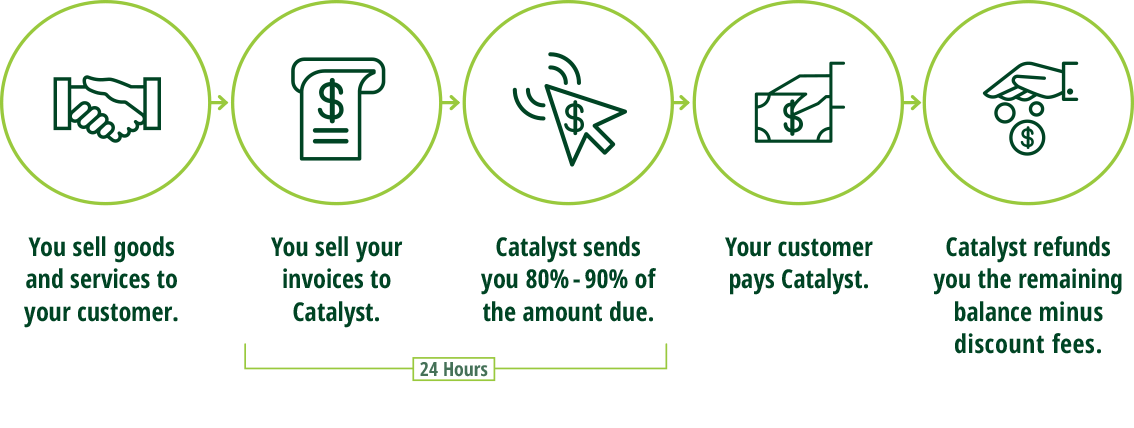

Application Process

SUBMIT AN APPLICATION

APPLICATION PROCESSED IN 24 HOURS

AFTER APPROVAL CATALYST PURCHASES YOUR INVOICE

FUNDING WITHIN 48 HOURS

CATALYST COLLECTS THE INVOICE FROM YOUR CLIENT

Testimonials

Another factoring company cut off their funding overnight so Catalyst filled the gap

"Catalyst helped me with a customer in desperate need due to their current factoring company stopping their service very suddenly. Catalyst acted quickly and professionally. They worked with me and the customer to get them back to work. It was an easy process, and they are always there to answer any questions the bank or the customer might have."

- Bank Partner

Factoring and equipment financing fueled this company's growth opportunities.

"I would totally recommend Catalyst. They really helped us to get to the next stage by not only offering factoring but also equipment financing and specialty loans to help us get to the next step of traditional line of credit with a bank. We would not be where are today without the help of Catalyst. They are a great solution for new and growing businesses. They have competitive rates and are large enough to service you but small enough to know you and help you grow."

- Amber Isaacks, Vice President, Jaguar Fueling

A new engineering company wasn't a good fit for bank financing so Catalyst stepped in.

"I would totally recommend Catalyst. They really helped us to get to the next stage by not only offering factoring but also equipment financing and specialty loans to help us get to the next step of traditional line of credit with a bank. We would not be where are today without the help of Catalyst. They are a great solution for new and growing businesses. They have competitive rates and are large enough to service you but small enough to know you and help you grow."

- Amber Isaacks, Vice President, Jaguar Fueling

THE FACTS OF FACTORING

Factoring is based on your customer's credit, not yours.

We provide funding to companies that have the right receivables – but not 30+ days to wait for payment. Factoring allows you to quickly and efficiently generate the cash necessary to meet overhead, payroll and other business expenses without giving up equity.

Many of our customers have never financed using accounts receivables financing. We're here to help you understand the process and make it work seamlessly for your business.